Buckhill Unveils New Visual Identity; symbolising our transformation into a more product and partner-centric brand within the insurance industry

December 1st, 2024

4 minutes to read

Our new brand represents our dedication to delivering enhanced, product-focused solutions tailored specifically for insurance professionals.

In an industry as dynamic and competitive as insurance, success hinges on the ability to anticipate and respond to evolving demands. Innovation thrives on a deep understanding of customer needs across every interaction. With that in mind, we are proud to introduce the newly transformed Buckhill, marking our commitment to a more focused and forward-thinking approach.

Our transformation: From service provider to a client-focused, partnership-driven software innovator

Over the past 10 years, we’ve built a strong reputation for delivering innovative insurance solutions, including AEGIS London’s award-winning Opal Underwriting Platform, powered by our C2MS platform, along with our trusted cloud security and authentication software, AuthStack.

Throughout this journey, we’ve come to realise that true success goes beyond technological advancements—it’s about truly understanding and addressing the unique needs of every client.

This insight has driven a significant evolution in our approach, now reflected in our new brand identity.

Our refreshed logo and visual design represent a more dynamic, product- and partner-focused Buckhill—committed not only to providing cutting-edge technology but also to offering the expertise, guidance, and personalised partnership that empowers our clients to achieve their full potential.

Unveiling the next stage of Buckhill

· A vibrant new logo

Our refreshed logo showcases a modernised buck, preserving the powerful essence of the original while embracing a sleek, contemporary design. The buck, symbolising strength, freedom, and adaptability, reflects the spirit of our company.

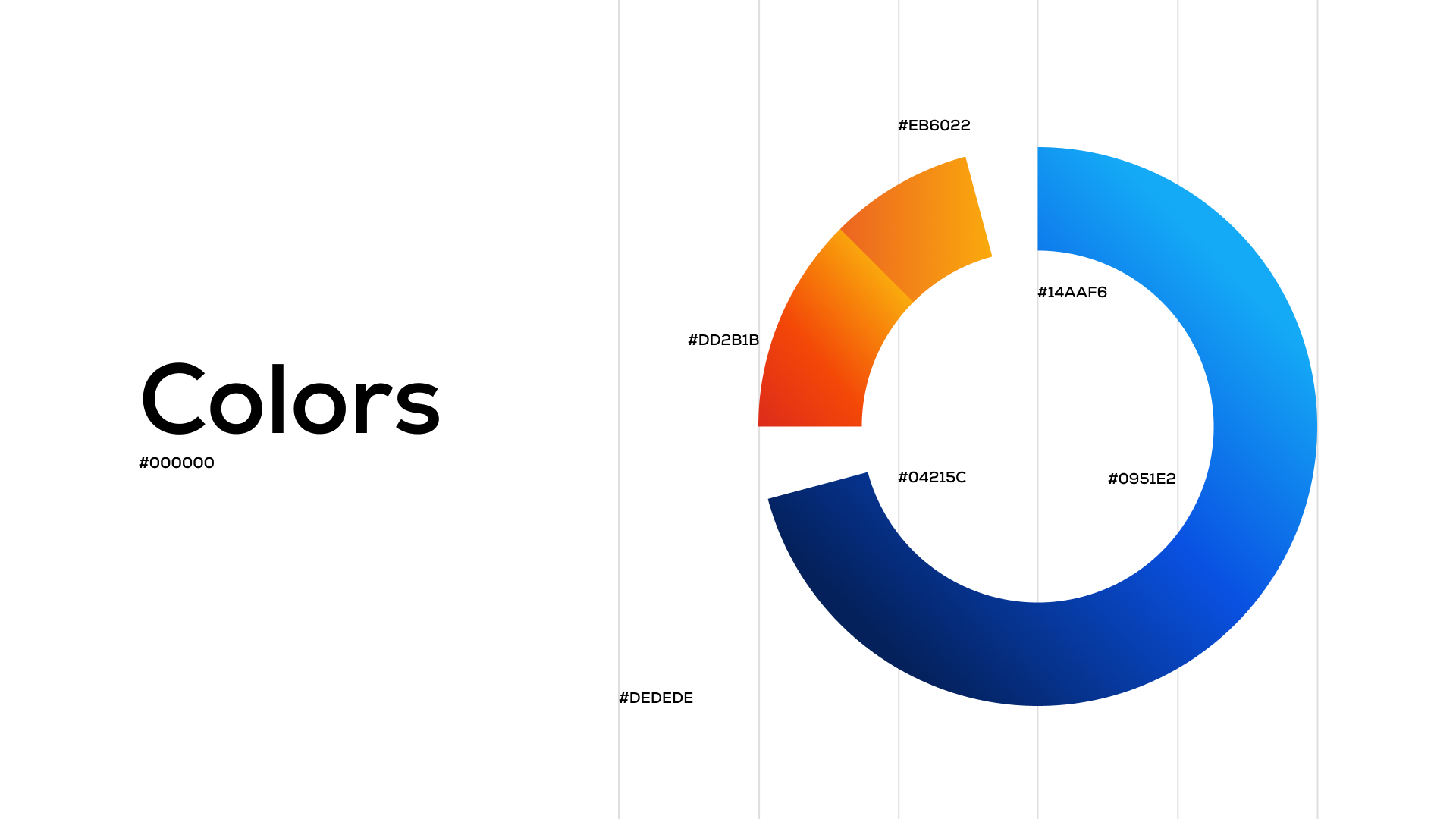

Its updated design retains the recognisable blue, representing the stability and consistency associated with the insurance industry, while introducing a bold orange accent that signifies our courage and passion for innovation and new possibilities.

The two colours, whilst closely aligned in parallel, do not cross over, symbolising how tradition and innovation coexist in harmony within our brand—complementing each other without losing their distinct identities.

· A refreshed colour palette

Our refreshed colour palette, seamlessly transitioning from vibrant orange to tranquil blue, captures the essence of our transformation. The gradient of orange symbolises our commitment to innovation, creativity, and a passion for progress. As the gradient gently shifts towards a calming blue, it evokes a sense of trust, consistency, and stability, reflecting the core values of the insurance industry and our approach to meaningful partnerships.

This carefully curated palette represents our dedication to balancing innovation with tradition, ensuring a future that is both dynamic and secure for our clients.

· New graphic expression

Our brand is a reflection of our constant evolution, mirroring the dynamic nature of our innovative solutions and the expertise of our team. Our revitalized brand identity embodies our core values – transparency, consistency, knowledge, and automation.

From Proven Results to Strategic Partnership: Bridging the gap between vision and implementation for insurance success

Building on our proven track record of delivering tangible results, we are proud to continue our journey towards insurance excellence by offering an extended suite of enhanced products and solutions designed to fulfil the evolving demands of the industry:

· Advanced Claims and Policy Management: Streamlined processes and self-service options for a more efficient and customer-centric experience.

· Modern Policy Billing System: Flexible payment options and automated billing to improve customer satisfaction and reduce administrative overheads.

· Innovative Quote and Binding Platform: Real-time comparisons and personalized offers to empower customers and increase conversion rates.

· Comprehensive Underwriting Workbench: Improved risk assessment and automated decision-making to enhance accuracy and speed.

· Secure Identity and Access Management: Robust security measures to protect sensitive data and ensure compliance with privacy regulations.

Join Us on This Journey

We are incredibly excited about this new chapter in Buckhill's story. We invite you to explore our new website, discover all our services, and learn how we can help you achieve your goals. We look forward to partnering with you as we continue to shape the future of insurance.

Stay tuned for more updates and announcements!

.png)

.png)