// Services

Insurance Rating Automation

Optimise your underwriting process with our advanced rating automation solutions. Leverage connected data analytics, open APIs and rule-based automation to deliver better accuracy, documented compliance and consistent premium calculations.

.01

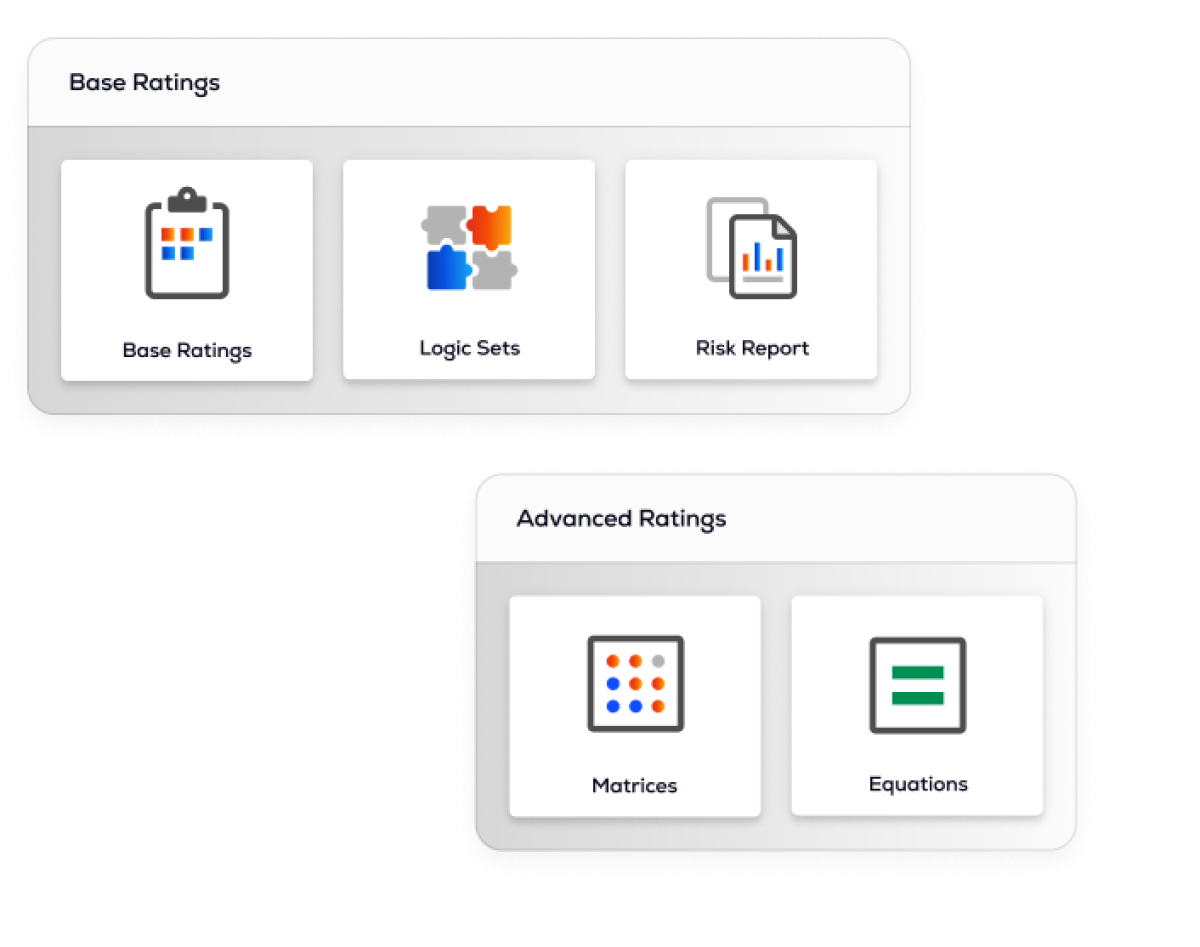

Flexible and Customisable Rating Engines

Our rating engines are built for adaptability. We configure them to reflect your unique business rules, underwriting guidelines and risk appetite while ensuring seamless connection with your systems and partner data sources. The result is precise, compliant premium calculations aligned with your needs and ecosystem.

.02

Real-Time Data Integration

Integrate seamlessly with your existing data sources, third-party feeds and partner systems. Access real-time information for accurate risk assessment and pricing across your network. Our rating automation solutions provide the connected data you need to make informed underwriting decisions and optimise pricing strategies.

Precise, Efficient, and

.

.03

Advanced Analytics & Reporting

Gain detailed insight into your rating performance with comprehensive reporting and connected analytics.

Our rating automation platform delivers detailed reports to help you understand performance, identify trends, link changes back to your systems and make data-driven decisions. Track key metrics, monitor risk exposures and optimise your rating strategies to improve profitability and competitiveness.

.04

Seamless Integration & Scalability

Integrate our rating automation solutions seamlessly with your existing insurance ecosystem.

Our platform connects to your policy administration, claims management and partner systems via industry-standard APIs and proven integration patterns. This ensures smooth data flow, minimal disruption and a scalable architecture that supports increasing volumes and transactions as you grow.

Ready to Optimise Your Underwriting?

Partner with Buckhill to transform your rating process and gain a competitive edge. Our expertise and advanced rating technology ensure accurate, efficient, and data-driven premium calculations.