// Products

Policy Billing System

Transparent, Connected and Compliant.

Simplify premium billing and payments through connected systems and partner integrations. AI-assisted reconciliation ensures accuracy, while our API layer provides real-time visibility and control across finance and operations.

.01

Elevate your Policy Billing System for Financial Control

Gain greater financial control and transparency with our flexible and scalable Policy Billing System where we provide automated invoicing, streamlined payment processing, and comprehensive reporting.

Increased Efficiency & Reduced Costs

Improve cash flow and reduce Days Sales Outstanding (DSO)

.02

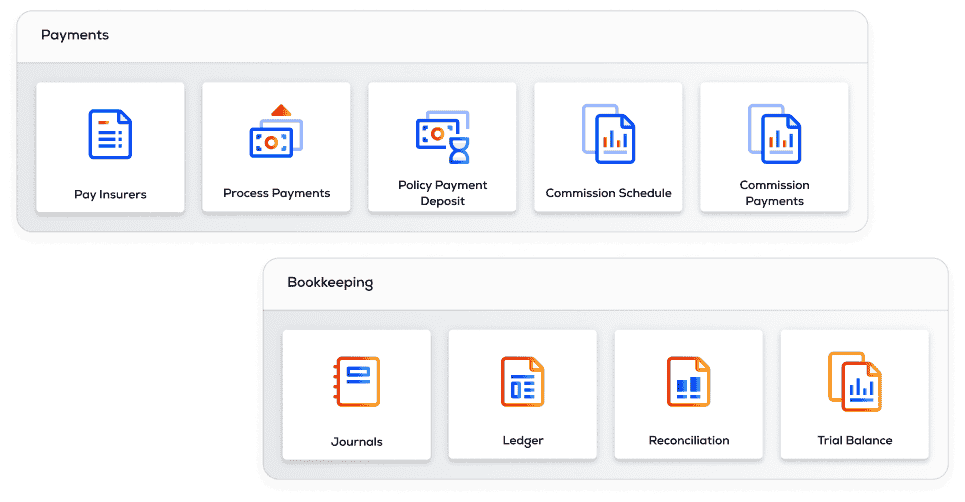

Comprehensive Features for Streamlined Billing

Our Policy Billing System offers a complete suite of tools to manage all aspects of your billing operations, from invoice generation and payment processing to commission calculations and accounting reconciliation.

Handle billing volumes, reduce errors and improve premium collection by connecting your core systems, partner services and payment gateways. Embedded intelligence flags anomalies so your team can act, not react.

.png)

Automated Invoicing

Generate accurate invoices automatically, based on policy details and pre-defined billing schedules. Say goodbye to manual effort and human error, and ensure timely and accurate billing for all your customers.

Secure Payment Processing

Securely process a wide range of payments directly within the system, both through customer portals and the back office. Support for credit and debit cards, BACS, direct debit, and premium finance provides your customers with flexibility and convenience. Our system adheres to industry best practices and security standards to protect sensitive financial data and ensure PCI DSS compliance.

Flexible Payment Options

Offer your customers a variety of payment options to meet their individual needs. This includes the ability to set up installments, recurring payments, and online payment portals, improving customer satisfaction and encouraging timely payments.

Commission Management

Configure flexible commission rules based on product, insurer, channel, and more. Automate commission schedules and even split commission payments in various ways over a set period, ensuring accurate and timely compensation for your agents and brokers. Our system provides detailed reporting and tracking of commission payments, giving you complete visibility and control.

Accounting Integration

Our system features a fully integrated, double-entry transactional accounting system designed to streamline and automate complex accounting workflows. Additional workflows can be added to partially or fully automate many accounting functions, improving accuracy and reducing manual effort. Seamlessly integrate with your existing accounting software to eliminate manual data entry and reconciliation.

.03

Seamless Integration, Robust Security

Designed for a connected insurance ecosystem, our billing platform delivers full audit capability, secure data flows across partner and core systems, and governance that meets regulatory demands. With open APIs and embedded intelligence, it ensures robust operational resilience and dependable performance.

Microsoft Azure

Azure platform offers secure backup and disaster recovery for cloud-based databases, including both Azure SQL and NoSQL variants. Utilizing this technology ensures data safety while harnessing the full potential of the cloud

Google Cloud Partner

Earning the status of a Google Cloud Partner entails a company exhibiting their proficiency in utilising Google Cloud technologies.

AWS Technology Partner

Being an AWS Technology Partner acknowledges our proficiency in providing exceptional customer experience, backed by a skilled team of certified technical experts.

.png)

Microsoft Cloud Solution Provider

Being a Microsoft Cloud Solution Provider gives us the capability to take charge of the entire lifecycle of customers in the Microsoft cloud. We can utilise exclusive tools to provision, manage, and provide support for customer subscriptions.

GoCardless

Partnering with GoCardless streamlines our payment processes, resulting in faster, more cost-effective, and highly secure transactions. This partnership allows us to securely access customer bank account data, empowering us to effectively mitigate risks.

Blink Payment

Blink Payment streamlines our payment processing, offering a wide range of options—from card transactions and Direct Debit to advanced open banking—all seamlessly integrated for a frictionless customer experience.

Optimise Billing,

.

.04

Enhance Your Billing Experience

Our Policy Billing System helps you enhance your customer's experience by providing clear and concise billing statements, flexible payment options, and convenient online payment portals.

Empower your customers to manage their billing preferences and make payments with ease, improving satisfaction and reducing inquiries.

€200 000 000 +

Premiums Processed Annually Through our Billing System

98%

Reduction in processing time

15 +

Years of Industry Experience

.05

Partner with Buckhill: Your Path to Digital Transformation

Embark on a collaborative journey towards insurance innovation. We'll guide you through every step, ensuring a smooth transition and maximising your success.

Step 1 - Discovery

We'll begin by thoroughly understanding your current billing challenges, processes, and integration requirements. This includes analysing your existing systems, data flows, and pain points to identify areas for improvement.

Step 2 - Solution Design

Based on the assessment, we'll design a tailored solution that meets your specific needs. This includes configuring the Policy Billing System to align with your billing rules, payment preferences, and reporting requirements.

Step 3 - Implementation

Our expert team will guide you through a smooth and efficient implementation process, ensuring minimal disruption to your operations. We'll seamlessly integrate the Policy Billing System with your existing infrastructure, including policy administration, claims management, and accounting systems.

Step 4 - Ongoing Support

We provide ongoing support and maintenance to ensure your continued success with our Policy Billing System. We'll also proactively monitor system performance and identify opportunities for further optimisation to maximize your efficiency and ROI.

Ready to Optimise Your Billing Operations?

Partner with Buckhill and experience the benefits of a streamlined, efficient, and customer-centric billing solution.