// Products

Underwriting Workbench

Intelligent and Connected Decisioning.

Streamline risk assessment and automate data collection with our Underwriting Workbench, giving underwriters the speed and clarity they need to make accurate, competitive decisions. Built on an integration-first foundation, the workbench unifies submissions, partner data, and internal systems into one cohesive view. AI-assisted summarisation and validation enhance accuracy, while configurable workflows support compliance and consistent underwriting outcomes.

.01

Efficiency, Accuracy, and Profitability

Equip your underwriters with the tools and insights they need to make faster, more accurate decisions, improving efficiency and profitability.

Increased Efficiency & Reduced Turnaround Times

Improved Accuracy & Consistency

.02

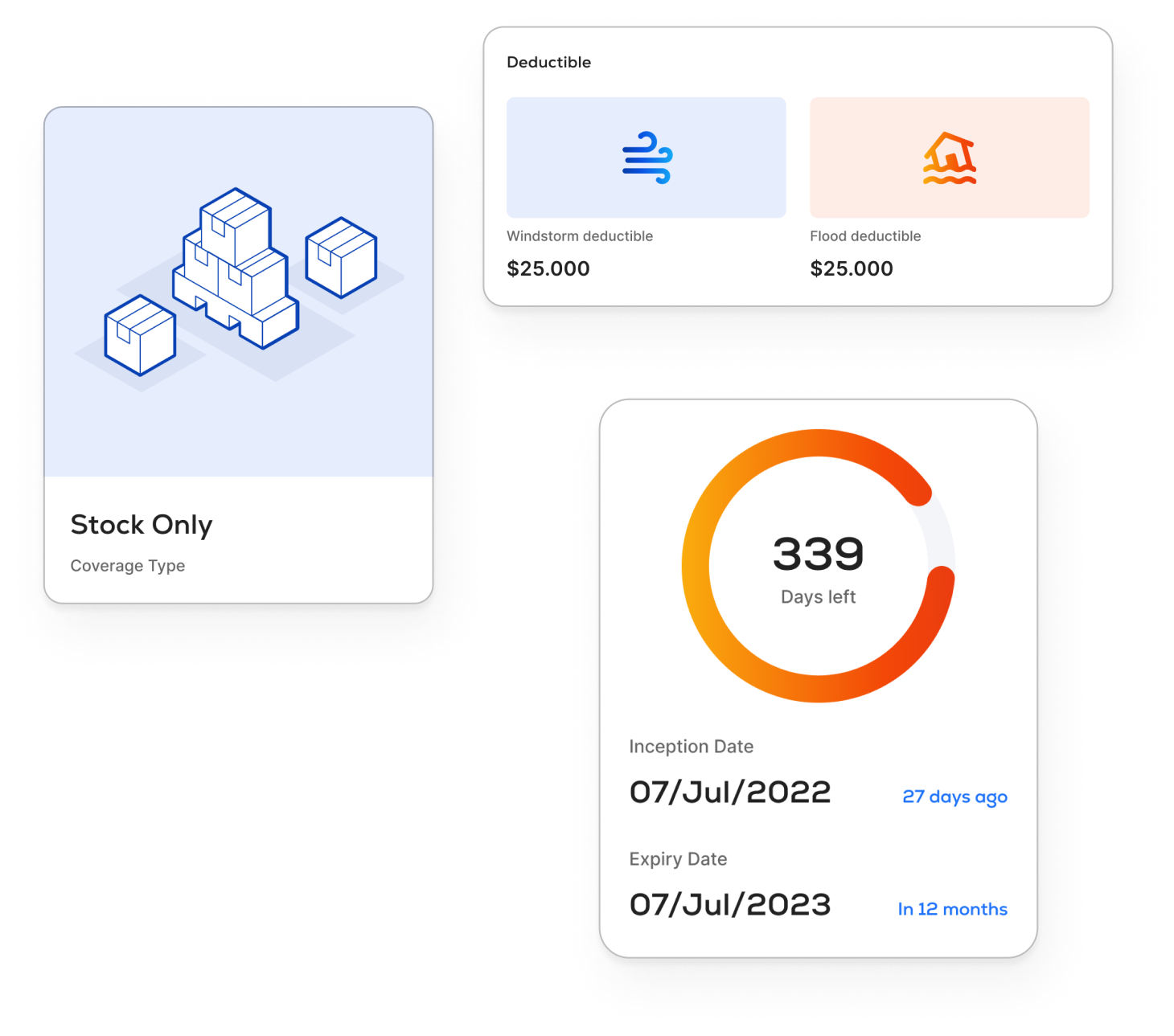

Comprehensive Features for Streamlined Underwriting

Our Underwriting Workbench provides a comprehensive suite of tools designed to streamline every stage of the underwriting process, from initial risk assessment and data collection to final decision support and reporting. Empower your underwriters with automation, data-driven insights, and seamless integration to enhance efficiency, accuracy, and profitability.

.png)

Automated Data Collection

Automate data collection from various sources, including internal systems, third-party databases, and external APIs. This reduces manual effort, improves accuracy, and allows your underwriters to focus on more critical tasks.

Risk Scoring and Assessment

Leverage sophisticated algorithms and rule-based logic to assess risk and generate accurate risk scores. This empowers your underwriters to make informed decisions quickly and efficiently, leading to better risk selection and improved profitability.

.png)

Decision Support Tools

Provide your underwriters with actionable insights and recommendations to guide their decision-making process. These tools help underwriters make informed decisions quickly and efficiently, improving turnaround times and customer satisfaction.

Real-time Rate Updates

Support real-time rate updates to ensure accurate pricing and competitiveness. Stay ahead of market changes and ensure your pricing is always competitive, allowing you to attract and retain customers.

.png)

Integration with External Services

Integrate with third-party services for data enrichment, such as postcode lookup, car registration lookup, flood risk assessment, and KYC verification. Access valuable external data to enhance your underwriting process and make more informed decisions, improving the accuracy and efficiency of your risk assessment.

Reporting and Analytics

Generate comprehensive reports and analyze underwriting performance to identify trends and areas for improvement. Gain valuable insights into your underwriting operations and make data-driven decisions to optimise your processes, leading to better risk management and increased profitability.

.03

Seamless Integration, Robust Security

Our Underwriting Workbench integrates seamlessly with your wider insurance ecosystem, connecting policy administration, claims management, billing, and data-partner systems. This creates a consistent, compliant, and connected underwriting process with a single flow of information. Open APIs ensure full interoperability, while governed automation strengthens accuracy, auditability, and operational control.

Microsoft Azure

Azure platform offers secure backup and disaster recovery for cloud-based databases, including both Azure SQL and NoSQL variants. Utilising this technology ensures data safety while harnessing the full potential of the cloud

Google Cloud Partner

Earning the status of a Google Cloud Partner entails a company exhibiting their proficiency in utilising Google Cloud technologies.

.png)

Microsoft Cloud Solution Provider

Being a Microsoft Cloud Solution Provider gives us the capability to take charge of the entire lifecycle of customers in the Microsoft cloud. We can utilise exclusive tools to provision, manage, and provide support for customer subscriptions.

AWS Technology Partner

Being an AWS Technology Partner acknowledges our proficiency in providing exceptional customer experience, backed by a skilled team of certified technical experts.

Loqate GBG

Loqate's address verification technology enhances data quality and minimizes fraud risk, ensuring we meet regulatory requirements. Additionally, their geo-encoding capabilities enable us to offer faster, more streamlined quote and bind solutions, requiring less human interaction and fewer questions for customers.

Smart Underwriting for a

.

.04

Empower Your Underwriters to Deliver Exceptional Service

Our Underwriting Workbench empowers your underwriters to provide a faster, more efficient, and personalised experience for your customers. By streamlining the underwriting process and providing access to real-time information, your underwriters can focus on building relationships and delivering exceptional service.

€200 000 000 +

Premiums Processed Annually Through our Products

98%

Reduction in processing time

15 +

Years of Industry Experience

.05

Partner with Buckhill: Your Path to Digital Transformation

Embark on a collaborative journey towards insurance innovation. We'll guide you through every step, ensuring a smooth transition and maximising your success.

Step 1 - Discovery

We'll begin by thoroughly understanding your underwriting process, challenges, and integration requirements.

Step 2 - Solution Design

We'll collaborate with you to tailor our Underwriting Workbench to your specific needs and underwriting guidelines.

Step 3 - Implementation

Our expert team will guide you through a smooth and efficient implementation process, ensuring seamless integration with your existing systems.

Step 4 - Ongoing Support

We provide ongoing support and maintenance to ensure your continued success with our Underwriting Workbench.

Ready to Upgrade Your Underwriting Process?

Partner with Buckhill and experience the benefits of a streamlined, efficient, and data-driven underwriting solution.